Welcome to VestRight

Teaching Land,

Growing Legacies

Learn

Partner

CODYBJUGAN

Land Developer, Investor, Mentor

Founder of VestRight

Founder of Allied Development

Cody Bjugan is a seasoned land developer who is a key player in development projects. These projects are a result of Cody's specialized experience in acquisitions and entitlements of OFF-MARKET raw land that has development potential.

He excels in negotiation and out-of-the-box problem solving to create win-win real estate transactions, which is where the idea of VestRight was born.

VestRight is an educational and coaching company dedicated to transforming lives by teaching real estate investors, real estate agents, and other entrepreneurs how to achieve financial independence through land acquisition deals.

Beyond his all-important task of being a husband and father, his mission as a devoted follower of Jesus, is to share so that we together can create fulfilling legacies through our purpose and impact.

Learn How To Close Multiple 6-Figure Profit Land Deals Right From Your Laptop — With Zero Risk, Experience, or Capital Required

Appreciation From Our Students

Respect From Our Peers

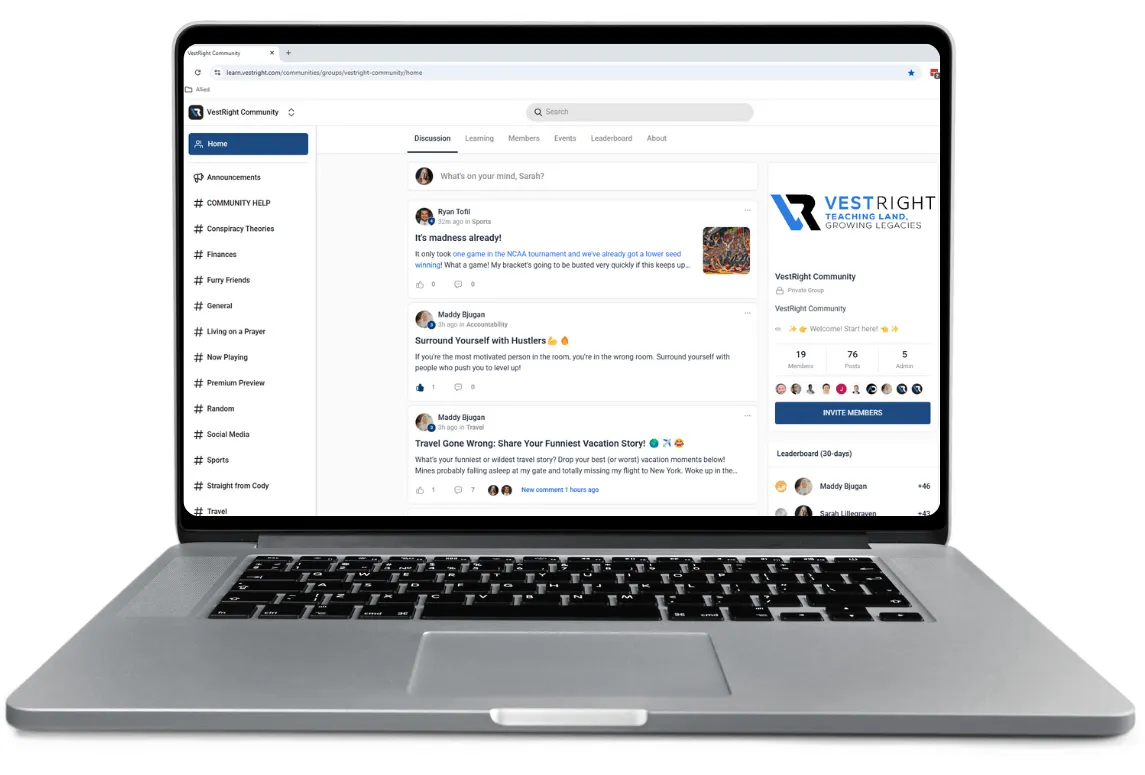

JOIN OUR

VestRight Community

Connect with other students to learn exactly how they’re making their way towards big opportunities in an untouched industry.

VestRight was founded by Cody Bjugan in 2019 to fulfill his life's mission he calls:

Most people know PIF in sales to stand for “paid in full”. Well, if you truly want to be paid in full, start with serving others.

“Purpose. Impact. Fulfillment. PIF was created to make a positive impact on lives through real estate and raw land development.

This is a part of Cody's legacy. To be able to come and share the wisdom and insights he has learned has allowed him to give back and make a difference in people’s lives.

PIF represents those who understand we are here to serve. His purpose is to have impact which provides him fulfillment – and this is the key to a successful life!

Figure out your Purpose, share it with others and help Impact their lives. Only then will you feel Fulfilled.

CODYBJUGAN

Learn How To Close Multiple 6-Figure Profit Land Deals Right From Your Laptop — With Zero Risk, Experience, or Capital Required

We're looking for new partners to mentor this month…

To get your questions answered and see if we're a fit, schedule a call with us today and we'll quickly determine if this opportunity is right for you or not.

We're looking for new partners to mentor this month…

Learn How To Close Multiple 6-Figure Profit Land Deals Right From Your Laptop — With Zero Risk, Experience, or Capital Required

To get your questions answered and see if we're a fit, schedule a call with us today and we'll quickly determine if this opportunity is right for you or not.

© 2025 VestRight® | All Rights Reserved

16430 N Scottsdale Rd Suite 210 Scottsdale, Arizona 85254

DISCLAIMER: The figures stated on this page are our personal figures and in some cases the sales figures of previous or existing clients. Please understand these results are not typical. We're not implying you'll duplicate them (or do anything for that matter). The average person who buys "how to" information gets little to no results. We're using these references for example purposes only. Your results will vary and depend on many factors including but not limited to your background, experience, and work ethic. All business entails risk as well as massive and consistent effort and action. If you're not willing to accept that, please DO NOT PURCHASE ANY VESTRIGHT COURSES.